London-based financial services firm Impax Asset Management administers a suite of equity, fixed income and private equity investments. The company has specifically pioneered investment in the transition to a more sustainable global economy.

Following a period of rapid growth, Impax engaged Protecht to design and implement a holistic, forward-looking risk management system.

Watch the video

The challenge

Following a period of rapid and substantial growth, Impax Asset Management realised that its fragmented, Excel-based risk systems had become insufficient for the changing needs of the business.

Whilst Excel had served the company well for years, new spreadsheets had continually been added to keep track of, for example, logs for data breaches, processes, vendor management and more. Over time, the system had become fragmented, cumbersome and impractical.

Impax needed a holistic, streamlined risk management system that could enable the risk team to improve their reporting abilities, bolster their analytical capabilities and optimise their processes.

We were operating with fragmented approaches, and different teams were recording issues and incidents. We realised that Excel is only sufficient to a certain extent and that what we really needed was to bring these fragments together to develop a holistic view and structured processes around risk management.

- Samir Arsiwala, Global Head of Risk, Impax

How Protecht helped

Protecht introduced a flexible, scalable risk management system that included a central repository for incidents and records, as well as a range of modules and automated workflow features to allow risk to be captured and managed in a consistent manner.

Moreover, Protecht adopted a collaborative, flexible approach to ensure that the final implementation took into account the full range of needs of the growing firm. This ultimately led to the original specification expanding – for example, third party risk management was identified as an additional need within Impax.

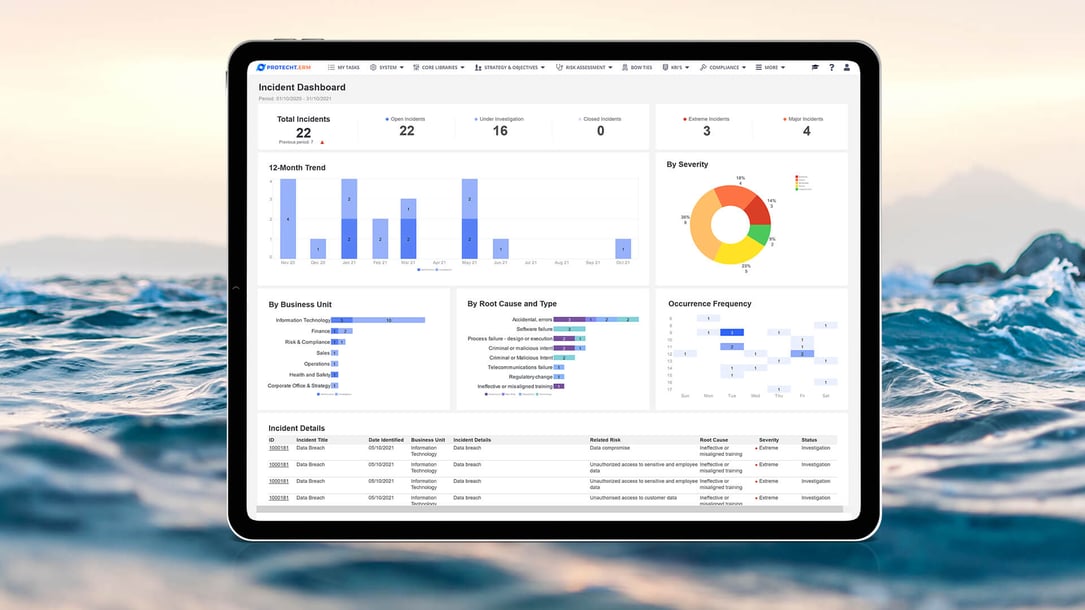

One of the most critical modules introduced by Protecht was the incident management process, which records all risk events in one place. This function enables holistic risk analysis, but also allows teams to perform historical analysis on risk incidents to ascertain where additional controls may be needed going forward. The introduction of this module has led to incidents being managed more efficiently and closed more promptly. Management are able to identify incidents trends and direct investment into the areas of control environment which need it most.

Protecht delivered a truly focused, but also highly flexible approach, resulting in a seamless journey.

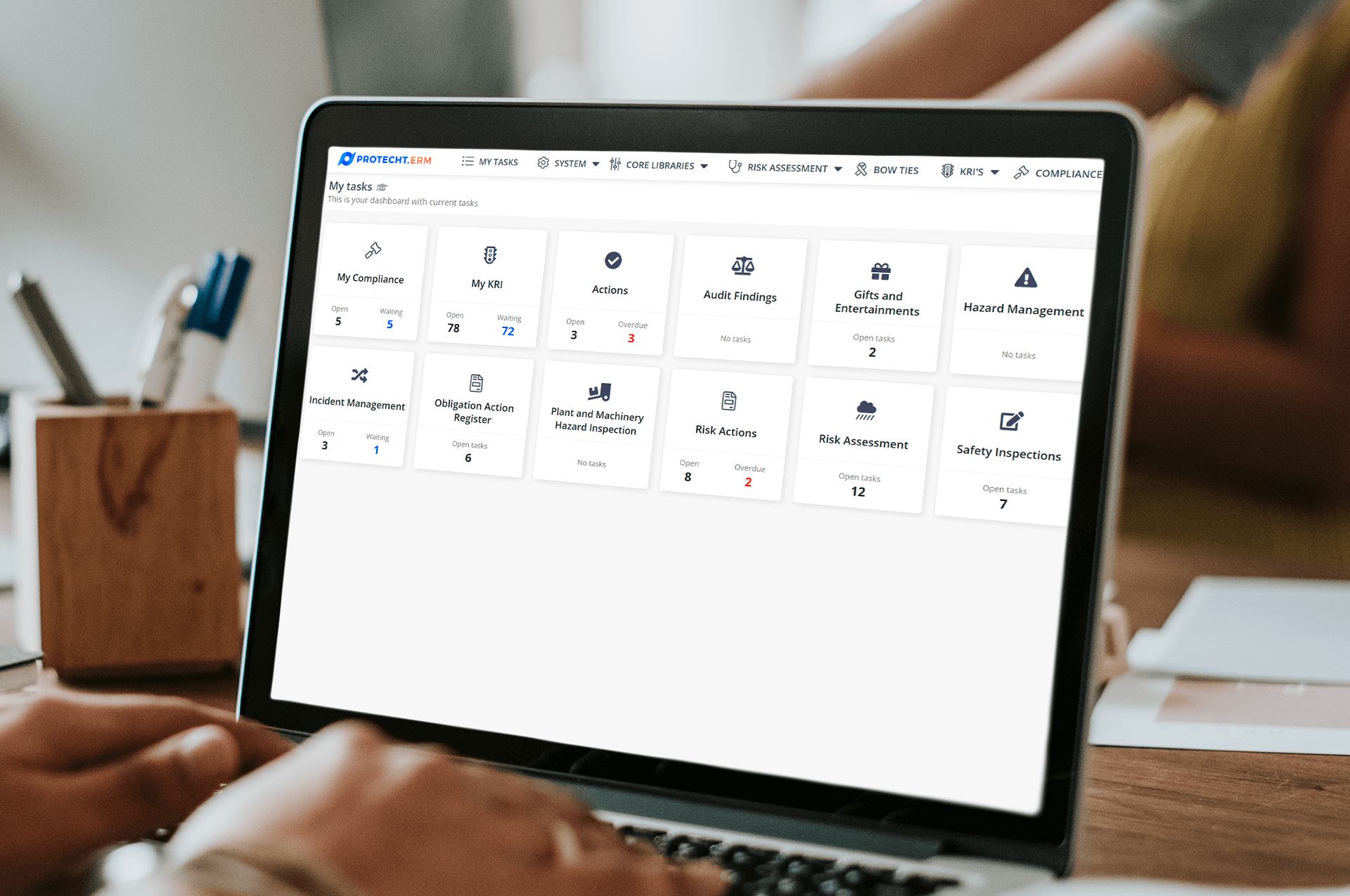

John Bastow, Chief Compliance and Risk Officer at Impax further explains that the introduction of a “My Tasks” dashboard has been a game changer, “A fully customisable personal dashboard tells each user exactly which tasks they need to complete. My Tasks is the first thing I look at everyday. This tool has really enabled us to embed risk management into the different business units – users can log in at any time and see the risk status of all upcoming actions. In addition, senior management are engaging more with risk management as the dashboards have become a prompt for regular dialogue between first and second line risk owners”.

The net result of these and other enhancements implemented by Protecht is that the risk function within Impax has evolved in line with broader industry changes. Risk management is no longer viewed as merely an administrative or tick box function, but is now forward-looking. This fundamental change in mindset means that Impax now proactively develops strategies to mitigate and manage their most significant risks.

The results

Protecht was able to add substantial value to the Impax risk management function, with specific benefits including:

The introduction of a single risk taxonomy

Impax now benefits from a consolidated approach to risk management. All actions and findings are housed in one place; and there are consistent online processes for critical functions such as incident management. This has translated into a substantial enterprise risk management benefit: whereas in the past, it was difficult to manage teams in different locations, these teams now all subscribe to the same risk taxonomy.

Better controls

Robust risk controls are critical in any organisation, and the Protecht implementation has strengthened these controls within Impax. Staff are now more willing to report incidents, because there are straightforward processes that can be followed. Having all relevant information readily available means that it is now easier to understand the causes behind incidents – especially repeat incidents – and implement additional controls to mitigate future risk.

Time and efficiency benefits

Impax executives report numerous time and efficiency gains as a result of automation and the ease of accessing all necessary information in one system. One employee stated that building reports previously took an hour and a half, but now takes no more than five minutes.

Improved accountability

Managers are now able to track all relevant information directly on the system and this has improved accountability within the environment, resulting in Impax successfully growing and optimising its risk culture.

Consultancy services

Protecht has offered invaluable advisory support to Impax throughout this transformational journey – offering advice; developing robust relationships with Impax team members; and delivering guidance around industry standards and expectations.

The switch from a fragmented, Excel-based risk management approach to a streamlined and holistic risk function has dramatically changing how risk is handled, viewed and managed at Impax.

Bastow sums up:

Our business is much more risk-aware now. Protecht has given senior management the ability see what is happening within different business functions, and this in turn allows the C-suite to plan for the future using a risk lens.

About Impax

Founded in 1998, Impax Asset Management has pioneered investment in the transition to a more sustainable global economy and today is one of the largest investment managers dedicated to this area.