Protecht.ERM is trusted by countless enterprises across dozens of different industries to deliver their ERM capability. Financial organisations that are influenced heavily by regulators - including banks, insurers, mutual ADIs and more - rely on Protecht.ERM for their governance, risk and compliance (GRC) needs.

Common mistakes people make when looking for enterprise risk management software

As you search for software for risk management, be sure to consider and avoid these common mistakes:

- Cobbling together systems: Using different software or strategies for storing risk assessment information, tracking risk metrics, establishing risk controls or recording details about incidents is risky in and of itself, especially when it comes to reporting to stakeholders and regulators. Software like Protecht.ERM gives you all these tools on one software platform, allowing more fluidity to risk management and understanding.

- Picking inflexible software: There is a lot of enterprise risk management software out there, but that doesn’t mean every platform is the same. Some software companies cater to specific industries or market niches with their software. It’s important to find one, like Protecht.ERM, that markets itself specifically as an inclusive, flexible and customisable software.

- Not training staff about compliance risks: The best software on the planet won’t save your organisation from compliance overload if you don’t have staff that are well-trained in industry and organisational best practices, internal policies and other factors. The Protecht Group offers both training workshops and risk advisory services to help businesses and their teams formulate a better understanding of what governance, risk and compliance looks like and how to efficiently manage it.

(L) Protecht.ERM Melbourne Client User Group; (R) Six Essentials of ERM Forum in London

Tips for getting more value out of your enterprise risk management software

If you decide to implement Protecht.ERM to drive your operational risk management and regulatory compliance, keep these tips in mind to maximise the value the software can have for your organisation:

- Take time to learn and customise the software: The more time your GRC professionals take to learn and customise Protecht.ERM, the more effective it will be as a tool within your organisation. Regarding compliance, you can configure Protecht.ERM to use custom workflows, migrate data from other sources to have everything in the same place, conduct surveys within your organisation, build custom forms, turn data into dashboards or reports and more. Utilising these features and tailoring the software and its capabilities to suit your enterprise needs, will drive successful compliance and GRC efficiency.

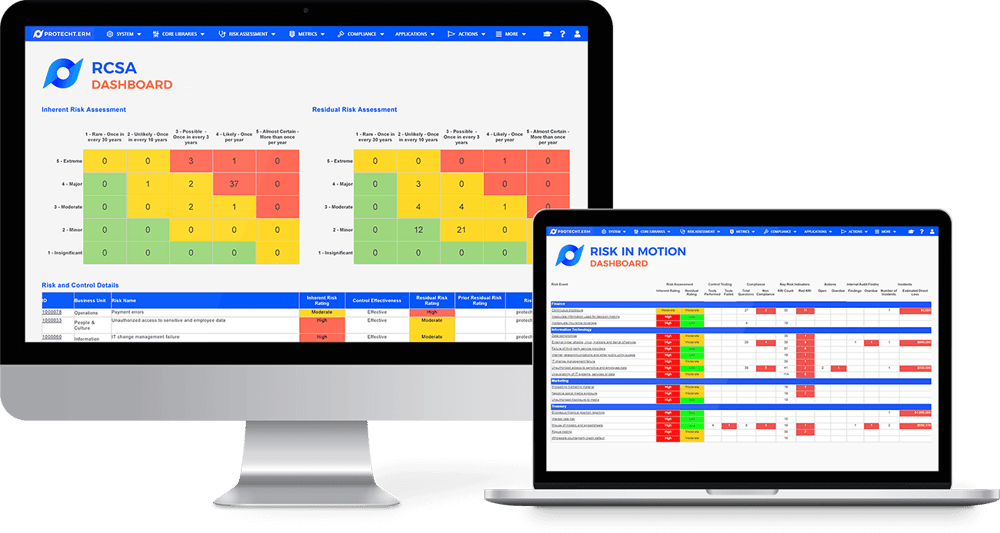

Screenshots of the Risk and Controls Self Assessment dashboard and the RiskInMotion dashboard in Protecht.ERM

Screenshots of the Risk and Controls Self Assessment dashboard and the RiskInMotion dashboard in Protecht.ERM - Take advantage of informational resources: Learning more about compliance and risk management is one of the best ways to improve your overall enterprise risk management strategy and capability. Even without enrolling in one of our seminars or hiring us for risk advisory, you can still learn through us by accessing one of our free eBooks or checking out one of our webinars.

Why trust The Protecht Group with your enterprise risk management?

When it comes to enterprise risk management, The Protecht Group and our Protecht.ERM software has you covered. Our business has been involved in the risk management industry for 20 years and has a long track record of success working with a wide range of clients, including businesses affected by regulatory compliance.

Contact us today if you are interested in a Protecht.ERM demo.