Much has been written about Silicon Valley Bank and many conclusions drawn by outsiders based on the available information. Failure of risk management, not following Banking 101, lack of a CRO, and so on are targeted as the cause of failure. While each may be true and each may have been contributing factors to the failure, the answer could be simpler – which voices were SVB listening to?

Back in 2018, I delivered some speeches and wrote a blog based on key learnings from the April 2018 Australian Prudential Regulatory Authority report into the Commonwealth Bank of Australia.

One of the key concepts of the APRA report was what I called the “Voices”. The report mentioned that financial services companies (and every organisation for that matter!) has a number of voices they need to listen to. Of particular mention were:

- The Voice of Finance (financial return for shareholders and executives)

- The Voice of Customer

- The Voice of Risk

The choir of corporate voices

I like to consider that there are two key voices, The Voice of Reward and the Voice of Risk. These voices then need to be listened to with respect to the various stakeholder voices. This provides a map of the corporate ‘choir’ as follows:

|

|

Voice of Reward |

Voice of Risk |

|

Voice of the Shareholder |

Reward to Shareholder |

Risk to Shareholder |

|

Voice of Executives |

Reward to Executives |

Risk to Executives |

|

Voice of Employees |

Reward to Employees |

Risk to Employees |

|

Voice of the Regulator |

Reward to Regulators |

Risk to Regulators |

|

Voice of Customer |

Reward to Customer |

Risk to Customer |

|

Voice of the Supplier |

Reward to Suppliers |

Risk to Suppliers |

|

Voice of Society |

Reward to Society |

Risk to Society |

|

Voice of the Environment |

Reward to Environment |

Risk to Environment |

Now the value of a choir is when all the voices are in harmony: one does not dominate the other, you may have a lead singer for a short time where there is a greater focus on that voice, but across the whole performance there is balance. This creates long-term sustainable reward. Where there is imbalance, things start to go wrong.

So to SVB, were the voices balanced? It seems not:

- Deposits were taken on at ever-increasing levels, even though those funds could not be constructively used

- The liquidity was parked in long-term bonds which at the time had better yields than short term investments. Interest rate risk was ignored for the pursuit of better margin

- Executives sold down shares in the weeks and months prior to its demise

- The Chief Risk Officer position was not filled for a period close to a year

- Attempts were made to lift the asset size requirements for tighter regulation to avoid that tighter regulation as the bank grew.

If we place these simple facts on the ‘choir’ sheet, we get a simple picture that:

- The voice of shareholder reward and the voice of executive management were strong

- The voices of risk were weak

So is it just a simple case of imbalanced priorities? These were smart people managing SVB – I am sure they understand risk management and banking 101, but perhaps yielded to the voice of reward rather than the voice of risk.

In the 1987 film Wall Street, Michael Douglas’s character Gordon Gecko famously says “The point is, ladies and gentlemen, that greed, for lack of a better word, is good. Greed is right, greed works.”

This may be true for short term ‘boom’ gains for a small number of stakeholders, usually the shareholders and executive management, but is certainly not true to build a long-term sustainable institution that creates value for all stakeholders.

I would like to think a remake of Wall Street would use the line: “The point is, ladies and gentlemen, that balancing risk and reward, across all your stakeholders, is good. Risk management is right, risk management works.”

Balancing the voices in reporting

How do we encourage and manage the various voices so as to be fairly balanced in our business lives? We need:

- Education of decision makers in the need to balance the various voices in all decisions

- Provide as much information as is available regarding each of the voices

- Report performance based on desired / optimal balance between the voices

All too often, we see board and management reports which focus on only one of the voices at a time. The voice of internal reward (usually financial voice) is the longest report and the one which has most time spent on it. The voice of customer reward is then shown separately, usually a much shorter report focusing on aggregate customer satisfaction/net promoter scores. The voice of internal risk is then tabled in a separate much shorter and filtered report, and finally the voice of external risk arrives last.

Reporting needs to table the voices together so that the balance can be understood and the quantity of data and therefore focus of each voice should be similar.

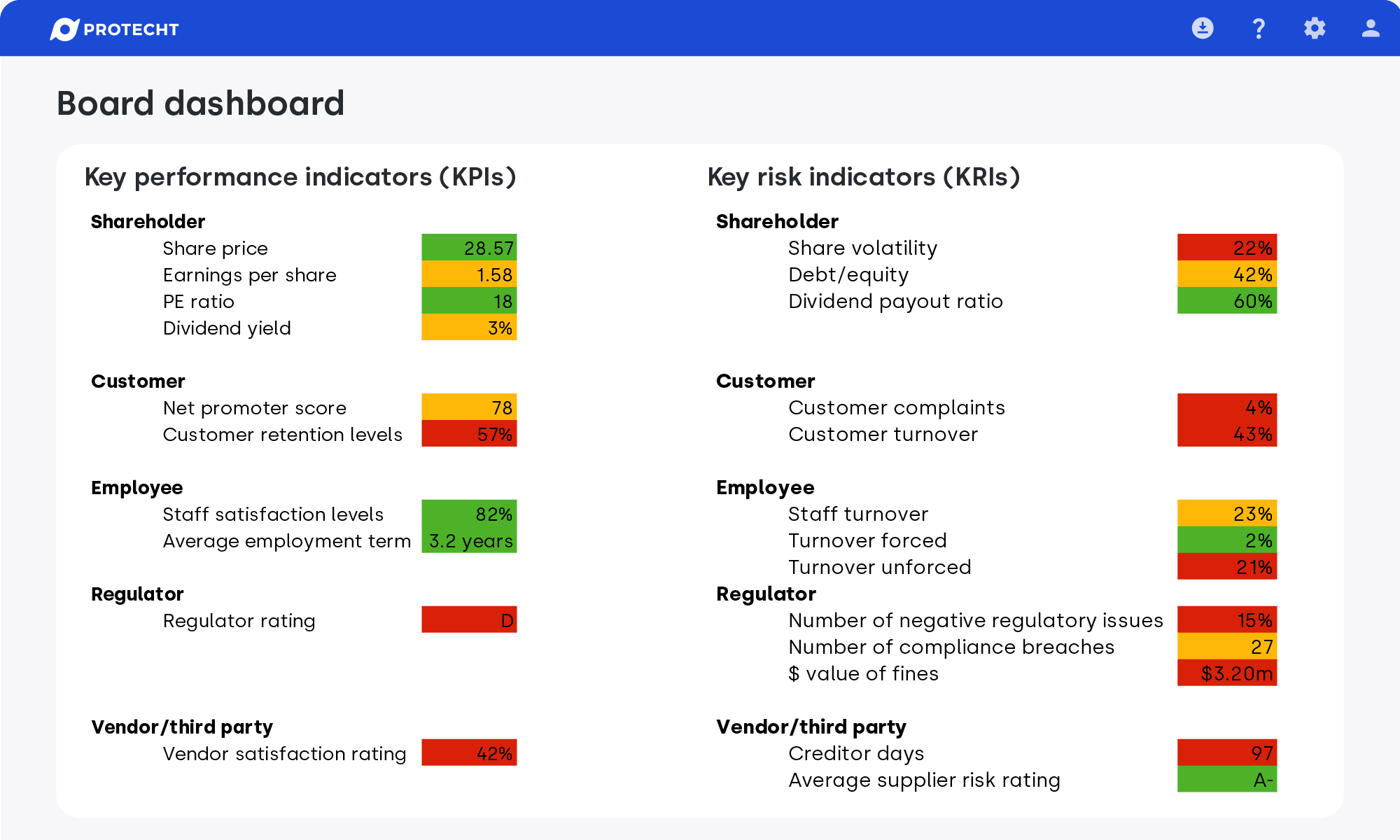

The following is an example reporting showing the voices of risk and reward from all relevant stakeholders:

This shows us that the voice of shareholder and employees are the strongest and customer, regulator and suppliers the weakest. It also shows the voice of reward (KPIs) is stronger or favoured compared to the voice of risk (KRIs).

This highlights that risk and reward information across the various stakeholders should not be viewed in isolation but instead brought together to provide a balanced snapshot of all the things that matter.

Closing thoughts and next steps

So what do you need to achieve this in your business? Here are some points to consider:

- Does your risk system allow you to collect and report on KPIs as well as KRIs?

- Does your risk system allow you to produce consolidated dashboards with your KPIs and KRIs brought together?

- Are your remuneration and incentive schemes based on this balanced view of performance and not on the “Sales Person of the Year” award?

- Do you have appropriate risk reward decision making practices and ability to document these decisions and have them challenged?

To find out more about setting key risk indicators, watch our free on-demand Risk Metrics and Key Indicators webinar. This webinar explores what enterprise risk metrics and key risk indicators (KRIs) are and how they add value to your business in the context of your wider Enterprise Risk Management framework.