Submit with confidence. Strengthen resilience beyond compliance.

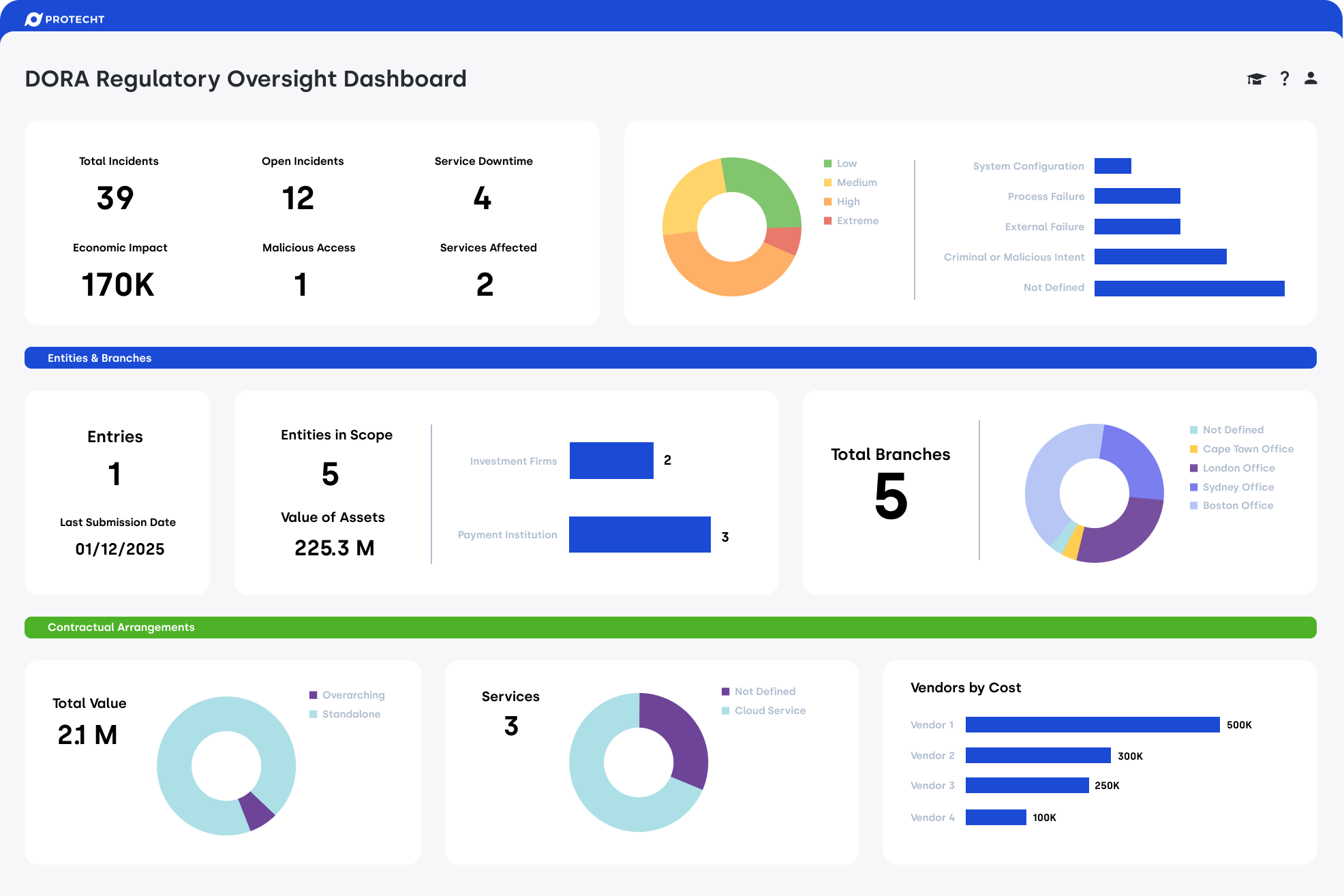

Built on firsthand experience supporting customers through their DORA submissions, Protecht now provides the tools to ensure faster approval and fewer rejections. With built-in validation, plain-language RTS translation, and a centralised, audit-ready register, you can confidently manage your digital operational resilience obligations from end to end.

Get it right. With Confidence.

For many organisations, submitting to the competent authority portal has been a frustrating process - with data model errors, validation failures, and multiple rejected uploads. Protecht ERM eliminates the guesswork by validating your submission before you upload it.

Identify issues, understand why they occur, and resolve them quickly - ensuring your submission meets the European Banking Authority’s (EBA) model rules.

Built-in validation reports

Check your DORA submission before uploading.

Protecht automatically detects data model and validation violations based on EBA rules, showing you exactly where an issue lies, what it means, and how to fix it.

Audit-ready register (Article 24)

Plain-language RTS translation

Integrated third-party oversight

.png)

Simplified data exports

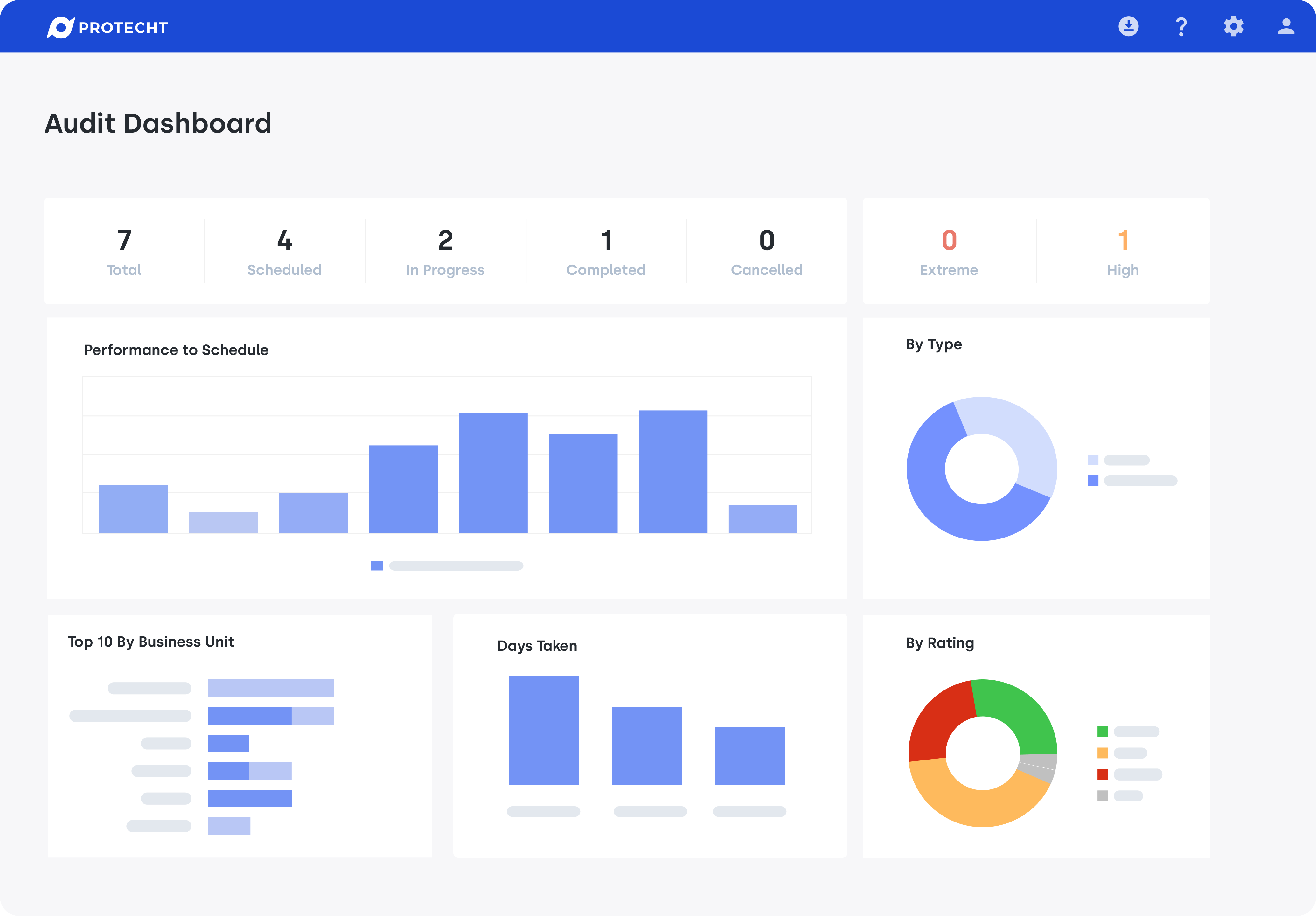

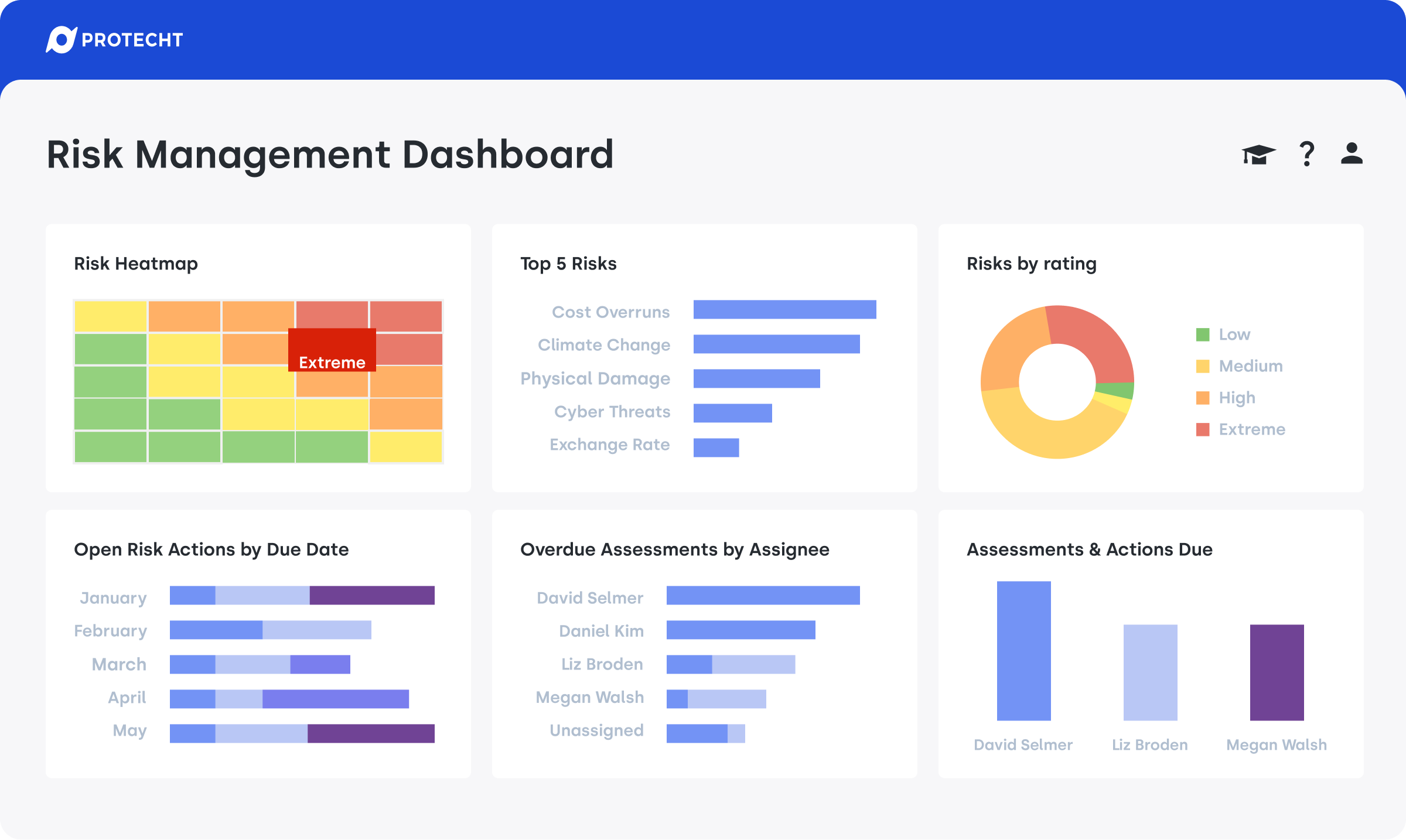

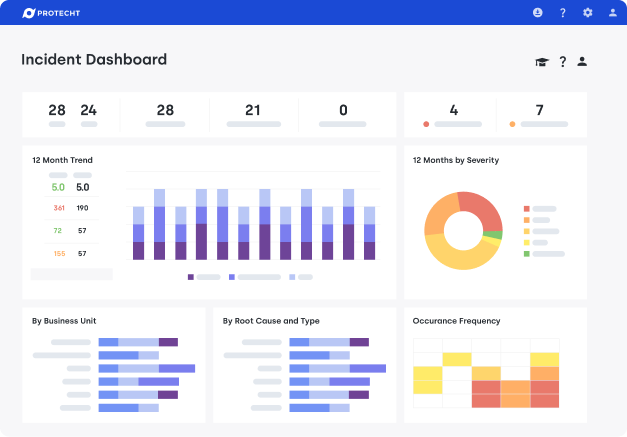

Turn DORA compliance into embedded GRC.

DORA isn’t just about meeting regulatory obligations - it’s about embedding resilience into the way your organisation operates. Protecht ERM connects risk, control, and incident management activities to ensure your DORA program remains current, traceable, and defensible under regulatory scrutiny

How Protecht ERM helps you meet Consumer Duty requirements.

Visualisation of the customer journey

Visualise your end-to-end customer service process via embedded process mapping. Identify where weak operational resources are contributing to customer detriment and infringing on customer rights.

Expert reviews

Templates for tactical and strategic reviews. Integration with control assurance activities enables deep understanding of the operational control environment. Deep-dive templates to support comprehensive product assessment and service reviews.

Testing and assurance

Enable management of issues identified through the fair value test process. Testing templates which enable evidence collection to support documentation management and the attestation process.

Continuous improvements

Interface for action management. Remedial actions and space to link actions coming from independent assurance reviews.

Governance

Governance templates for annual board attestations and reports. Underpinned by workflow alert tool which provisions for the dependency on accuracy and timely completeness of data.

Compliance monitoring

Templates to support ongoing testing and assurance of customer outcomes. Adherence to customer collateral and contracts. Link compliance rules and obligations to assessments to support attestation process. Management reports providing comparative analysis on revenue generation KPIs vs customer KPIs over time.

Analytics

Designing product insights to demonstrate good outcomes. Ability to reconcile customer outcomes vs risk appetite. Integration of external data points (e.g. use open banking data to identify where customers' money not working hard for them). Informed decision making based on research and information.

Learn moreTrusted by well known organisations

Why Protecht

Move from manual effort to measurable impact with Protecht.

Move faster and make better decisions with a single, connected system for risk, compliance, and assurance:

- Proven experience supporting regulated organisations through their DORA submissions.

- Technology built on lessons learned from real-world submission rejections.

- Comprehensive coverage across all DORA pillars - ICT risk, incident management, third-party oversight, resilience testing, and information sharing.

- Continuous updates to align with evolving EBA requirements and validation rules.

.png)