Risk management is changing faster than most systems can cope

We see the study’s findings as a reflection of a broader shift in the market. Risk teams continue to face volatile conditions such as geopolitical uncertainty, increased regulatory expectations, supply chain pressures, and new categories of cyber and operational risk. Yet many still operate with fragmented systems and spreadsheets.

Forrester’s interviews of Protecht customers found that organisations’ previous environments created:

- Blind spots due to siloed data and inconsistent reporting

- Excessive manual effort, especially for risk registers, controls, and model risk attestations

- Difficulty scaling as the organisation grew

- Regulatory readiness gaps, with leaders unable to confidently demonstrate compliance.

These themes drive the central message: Protecht helps organisations unlock measurable value by simplifying and unifying risk workflows.

The ROI snapshot

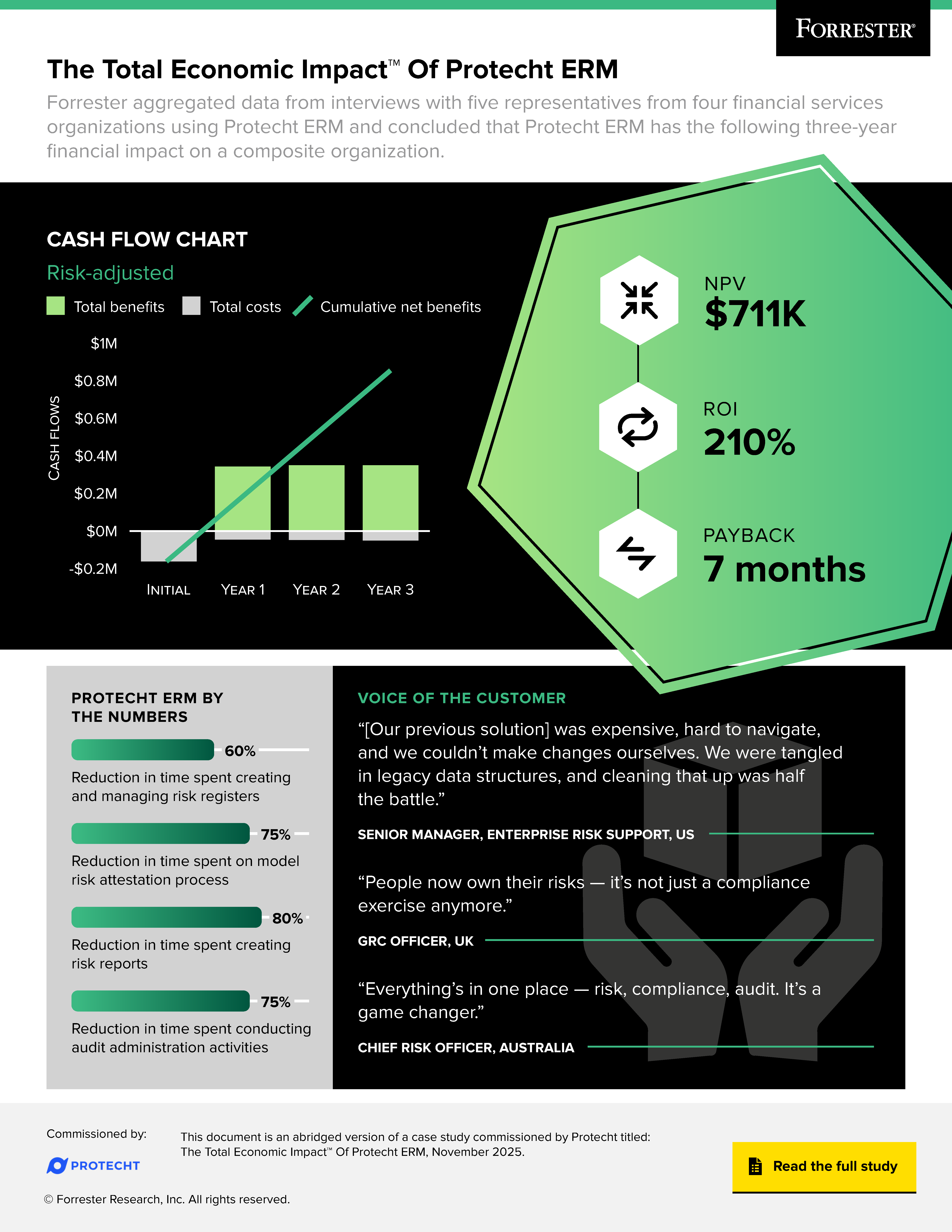

The TEI study summarises three headline metrics:

- 210% 3-year ROI

- $711K 3-year NPV

- 7-month payback period.

These are risk-adjusted figures calculated through Forrester’s TEI model, a structured methodology that evaluates costs, benefits, and flexibility using conservative assumptions.

They reflect the experience of a composite financial services organisation built from real customer interviews, not a single customer’s results.

The infographic provides a clear, impactful summary of these findings, but the implications deserve a deeper look.

The engine behind the numbers: major operational efficiencies

The striking reductions highlighted in the infographic come directly from the customer interviews underpinning the Total Economic Impact™ study. But the real story sits beneath the numbers.

- Risk register and attestation automation

Interviewees described how manual register updates and attestation cycles consumed disproportionate amounts of specialist time.

The full study details why these improvements were so significant, and how they translated into the single largest category of quantified financial benefit for the composite organisation.

- Reporting that no longer needs rebuilding every quarter

Before adopting Protecht, reporting cycles were often clunky, repetitive and error-prone. The move to configurable dashboards transformed that experience. The study outlines exactly how these time savings emerged and the scale of the operational impact.

- Lower technology and services costs

For some organisations, the shift wasn’t just about efficiency. The study details how replacing rigid legacy systems or eliminating external data-management costs also contributed to the composite organisation’s overall ROI.

- Faster, cleaner audit administration

Audit closures were another area of improvement. The headline: a 75% reduction in administration time. The deeper explanation of how this was achieved (and why it should matter to you) is explored fully in the study.

- The human and cultural impact: value that goes beyond cost savings

In addition to the measurable efficiencies in the infographic, the interviews uncovered another layer of impact that is harder to quantify but just as significant. Several interviewees described how the shift to Protecht changed the way people interacted with risk.

The study also explores a range of strategic, non-quantified benefits, from better oversight and incident transparency to the ability to quickly create new registers without consultants. Download the study to find out how these human and cultural factors contributed to overall value, and why they featured so strongly across customer interviews.

Why download the study?

If you’re preparing a business case, presenting to your board, or evaluating options to replace spreadsheets or legacy GRC, the Forrester Consulting Total Economic Impact™ Of Protecht ERM study provides the depth you need to understand how Protecht delivered measurable impact for the composite organisation, and how such benefits could apply in your own environment.

Get the full study:

See the impact in your own environment

The infographic shows the headline gains, and the study provides the detailed economics. But the best insights come from seeing Protecht mapped to your own workflows, risks, obligations and reporting needs.

If you’re exploring a modern GRC platform, whether replacing a legacy solution or moving beyond spreadsheets, a personalised demo can help you understand the potential value in your context.

Whether you’re moving from spreadsheets or upgrading your GRC solution, our specialists can provide you with a roadmap for your Protecht journey. Request an appointment now and we’ll put you in touch with the right experts for your journey:

Source: “The Total Economic Impact™ Of Protecht ERM,” a commissioned study conducted by Forrester Consulting on behalf of Protecht, November 2025.