Specialising in digital P2P money transfers, WorldRemit is a fast-growing remittance firm.

Over the last twelve years, the business has grown to serve 5.7 million customers, using 70 different currencies, across 130 countries worldwide. WorldRemit’s mission is to be chosen by its customers to enable their ambitions, wherever they are in the world.

When WorldRemit set out to find the ultimate ERM system, there would be no compromise.

“Protecht has really helped us in streamlining the risk management processes. The fact that our users can go into the system, update their own key risk indicators, update their own risks, has been really powerful for us.”

Tsam Jeffries, Director of Enterprise & Operational Risk, WorldRemit

Download this case study as a PDF

The challenge

A global business with over 1,000 employees working across a multitude of regulated jurisdictions. A fast-paced environment, with busy first-line executives who needed risk control and management to be efficient and effective.

WorldRemit needed a significant upgrade to their largely manual ERM framework.

“Risk had been managed through a series of spreadsheets that were difficult to consolidate and were not effective in proactively managing risk and control remediation,” says Tsam Jeffries, Director of Enterprise & Operational Risk. “Engagement among first- and second-line staff was limited due to the lack of available data and analysis which meant that more onus was put on our central risk team to lead risk management activity. We needed an efficient, scalable system that would enable every user to take personal ownership of ERM.”

Producing risk reports for internal meetings and regulator requests was time consuming, as data had to be manually consolidated from multiple sources in different locations. Action tracking was manual and not optimised, particularly in relation to Board and Committee actions and Internal Audit.

How Protecht helped

Protecht was launched to underpin a revamp of the ERM framework at WorldRemit in 2022. Key functionality included risk event (or incident) reporting and remediation, risk and control self-assessment, and risk appetite and key risk indicators. Being able to collate group-wide information in one place using a common taxonomy improved risk oversight and reporting significantly. Personal accountabilities are also clear, with user interfaces providing an immediate view of a user’s current status and outstanding actions.

Says Craig Wordsworth, Senior Manager, Enterprise Risk, “a favourite feature in Protecht is the My Tasks dashboard. It’s the first thing you see as you sign on, and it tells you everything – what you need to do and when – in one view. Your risk profile is right there, it’s live. It’s got your name on it.”

Protecht.ERM gives WorldRemit’s users the insights they need to take ownership of their ERM accountabilities.

Use of Protecht has extended to include Boards and Committee management, policy document management, Internal Audits, risk and compliance deep dives and assurance reviews, and project risk management.

Arnab Roychowdhury, Director, Compliance says “right now, I’m collaborating with colleagues from other departments in an exercise to upgrade our policies across the organisation, and Protecht ERM is invaluable in this work. We can track the status of all policies in the Policies and procedures module.”

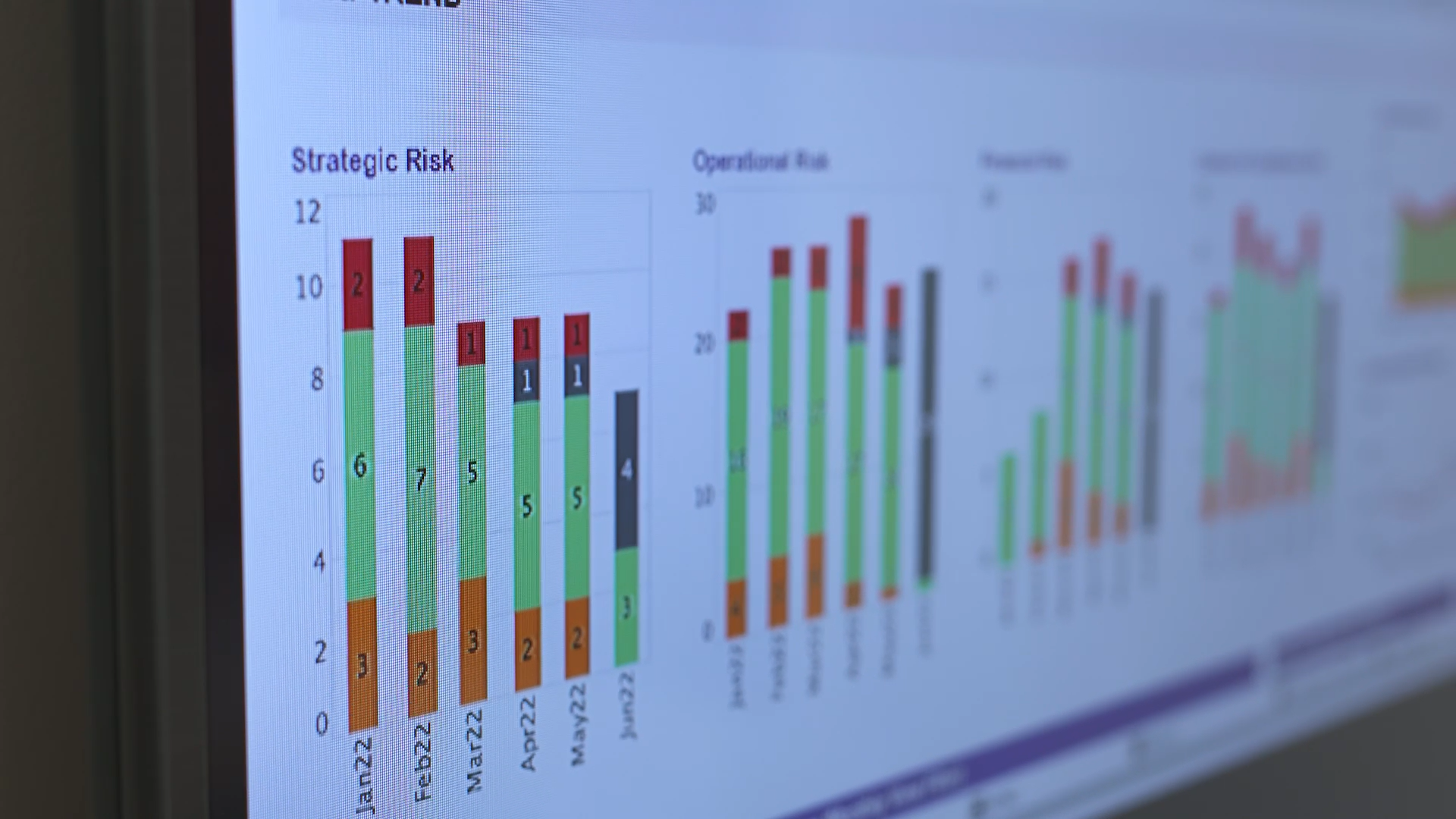

Dashboards have significantly improved the efficiency of report creation for senior stakeholders and oversight meetings, and provide a live consolidated snapshot of the risk and control environment.

“In collaboration with Protecht’s team, we’ve been able to tailor dashboards and reports to the very specific needs of our various types of users”, comments Nick Campbell, Senior Manager, Enterprise and Operational Risk.

“The Protecht advisory staff are a great sounding board for ideas. The advice and guidance we receive on enhancements and updates are very much appreciated.”

Nori Hesviandani, Manager, Risk, WorldRemit

Self-service drives integration with daily workflows

An aspect of Protecht.ERM that appealed very strongly to WorldRemit is its self-service approach, which empowers managers in the first line whilst also creating efficiencies for the second line risk team.

“Before we had the Protecht system, we managed things through spreadsheets and manually through documents. There was a lot of back and forth with the business and we had to control all that centrally”, says Tsam Jeffries. “The benefit of having a system now is the business can self-serve, they can go in and update their risks and actions on the system”.

Protecht.ERM’s single-sign-on functionality has made it easy for everyone in the business to use the software, driving uptake and usage. Senior managers in business units can use the software to understand their risk profile and required actions. At the same time, the central risk function has reduced time spent on creating packs for Boards and Committees.

As people within the business get increasingly aware of Protecht.ERM’s functionality, Tsam Jeffries sees its usage becoming even more integral to WorldRemit’s management process: “We'd like to get to the point where the business is fully sufficient in self-serving so they can see all of their risks and manage all their actions”.

The results

A new, proactive and more collaborative ERM culture is taking shape at WorldRemit. Here are some of the reasons why:

Seamless digitalisation

Without losing anything in translation, WorldRemit could easily consolidate data from a wide range of digital and paper-based sources in Protecht ERM.

Increased adoption

Staff members always know what they have to do and when – and how their assignments relate to policies, controls and events. This makes it easy for users to take ownership of their accountabilities.

Organisation-wide insights

Central management enjoy holistic views of the entire organisation as well as granular views of individual subsidiaries and departments.

Improved international collaboration

Referring to a single source of truth, WorldRemit staff can now liaise efficiently no matter where they’re located.

Improved risk controls

Since the right staff members are immediately alerted and kept aware of any issues or outstanding assignments, they can take swift and accurate action – and with increased understanding of ERM, they are better placed to identify new risks.

Real-time reports and audits

What used to take days now takes minutes – in a few clicks, managers can consolidate real-time data from multiple sources and create custom reports for boards, committees and regulators.

Informing the board

WorldRemit’s Board Risk and Compliance Committee have welcomed Protecht.ERM, as it gives them visibility of dashboards and trackers to stay informed around key actions and themes.

Conclusions

By providing a single source of truth that’s accessible across the business, Protecht.ERM has supported WorldRemit in revolutionising its approach to risk management.

“Everything our staff see in Protecht ERM is relevant – and therefore meaningful – to them, and that inspires a sense of ownership and diligent action.”

David Wheatley, Senior Assistant Company Secretary, WorldRemit

About Protecht

The Protecht Group provides complete risk solutions, including the world-class Protecht.ERM enterprise risk management platform as well as compliance, training and advisory services, to businesses, government organisations and regulators across the world.

About WorldRemit

WorldRemit is a leading global payments company with a focus on taking international money transfers online – making them safer, faster and lower cost. WorldRemit operates in more than 5,000 money transfer corridors worldwide and employs over 1,200 people globally.