Solutions for every scenario

Flexible risk management.

Designed by risk experts.

Purpose-built risk AI. Trusted where it matters most.

Get ready to meet Cognita by Protecht. Your intelligent AI assistant for risk and compliance.

Backed by the trust Protecht has earned with businesses, regulators and central banks worldwide, Cognita identifies critical gaps, guides users in real time, and automates admin so you can focus on decisions, not distractions.

Cognita combines deep risk expertise with proven AI safety to deliver intelligent automation you can actually trust: built to enhance decision-making, not disrupt it.

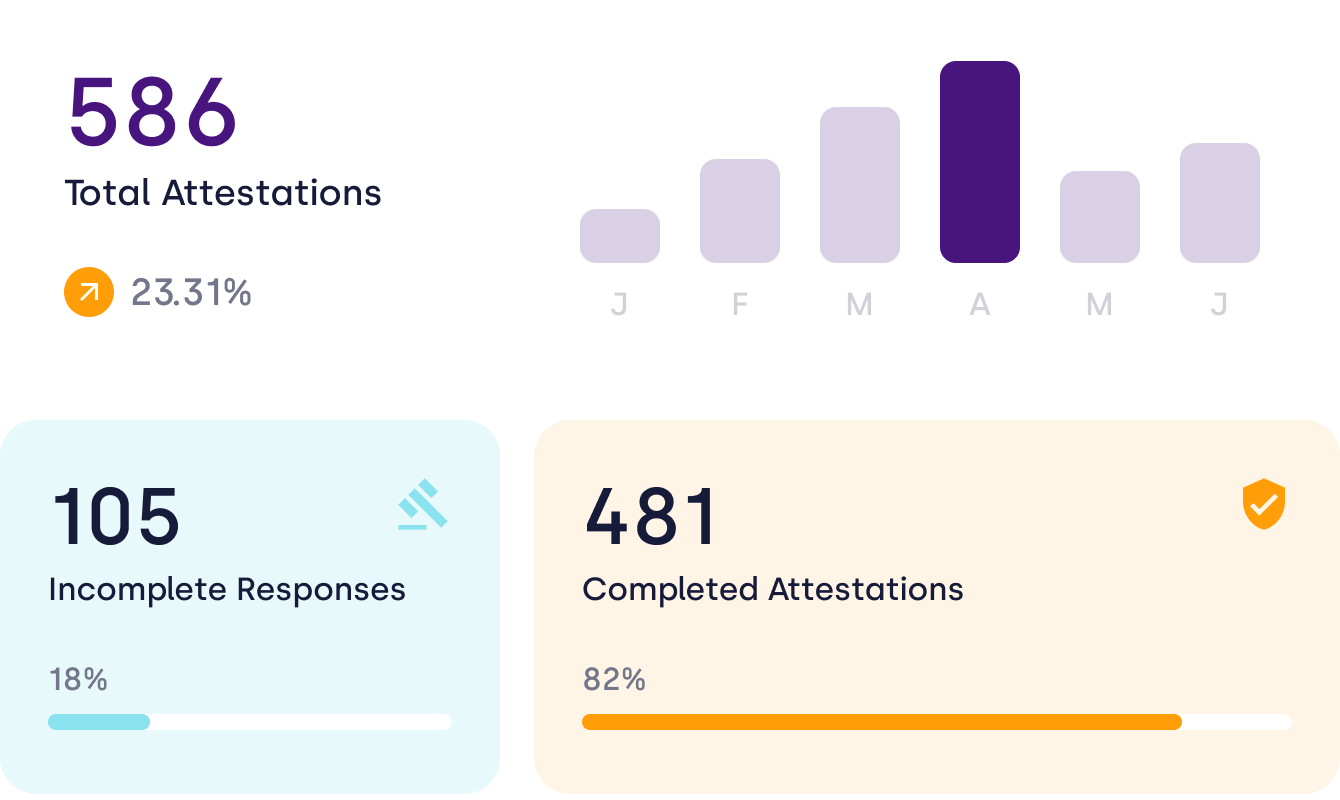

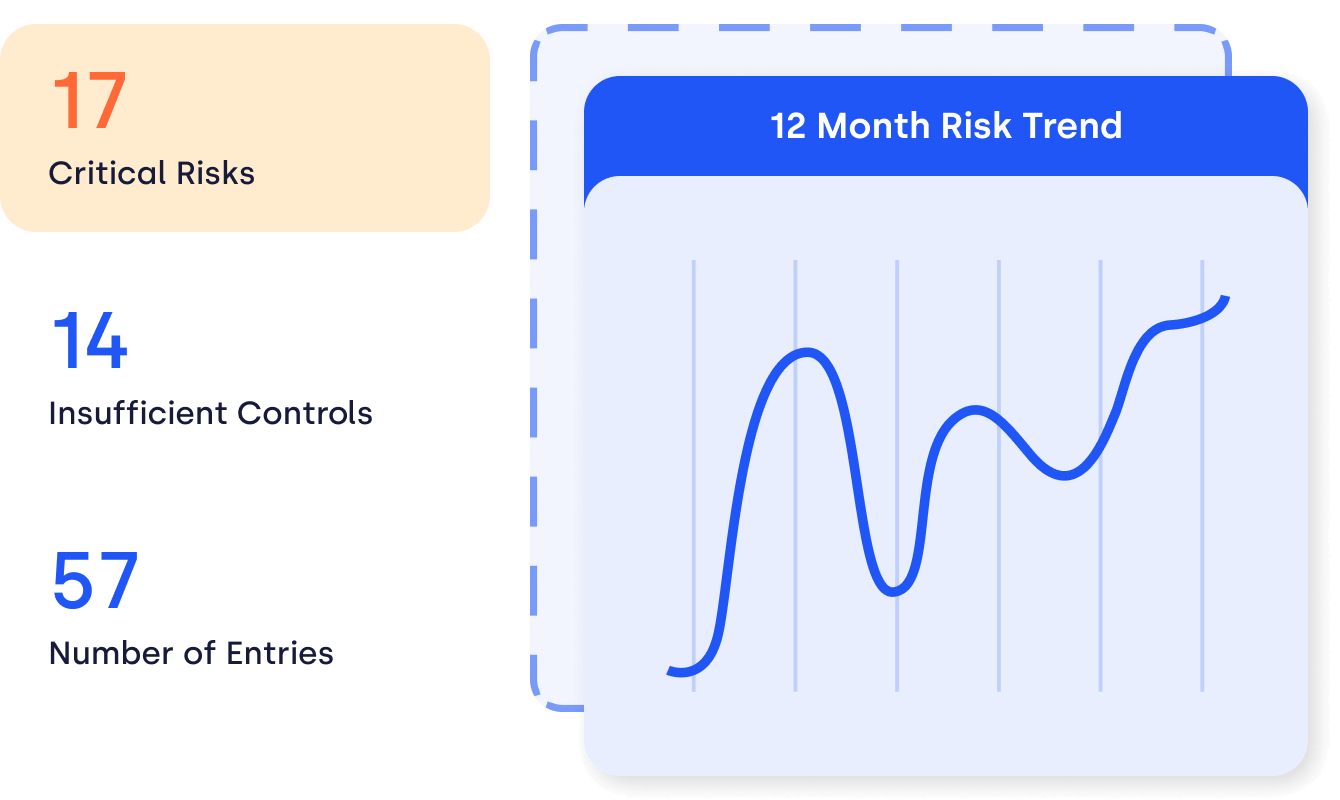

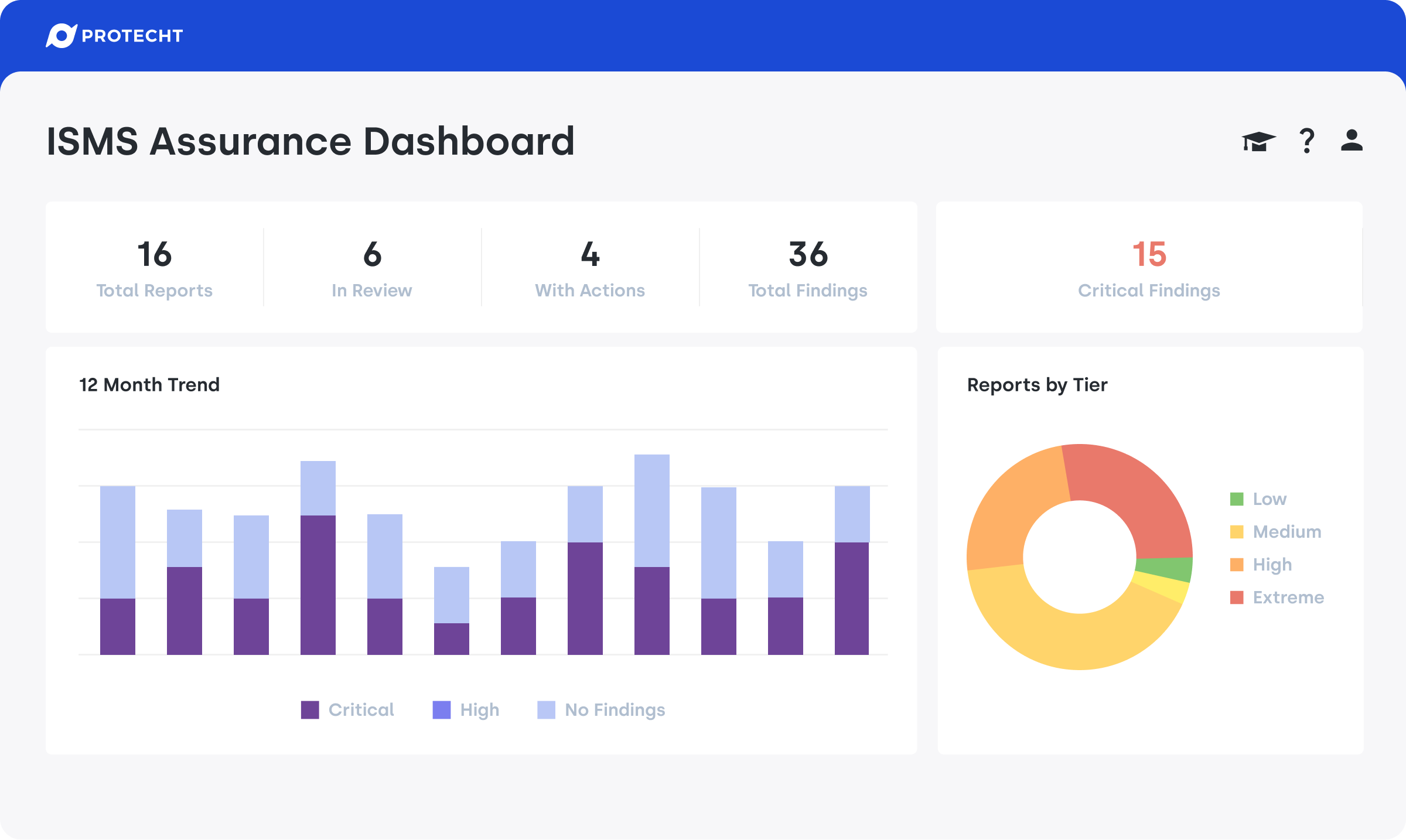

Your insights. Made for action.

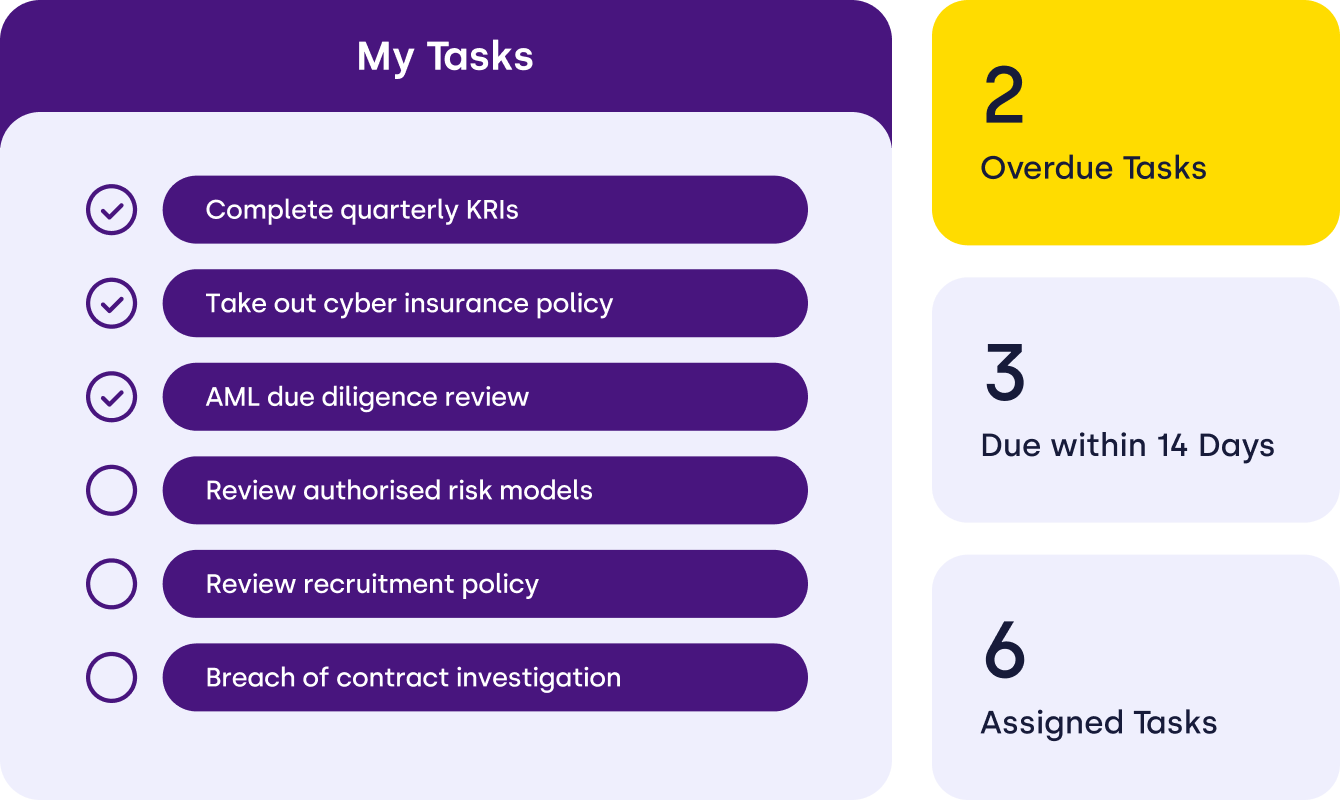

Get a full picture of your business’s risk profile – so you can make better strategic decisions faster. Protecht’s platform delivers interconnected, structured data through dashboards and reports that can be easily categorised and documented. So you can spot trends and identify areas that need the most action. And bring important stakeholders along the journey too.

A platform of possibilities.

Our system can be configured to your business’s unique needs without any coding. With features like a dynamic form builder, the capability to automate notifications and email alerts based on your unique needs and customisable risk assessment scales, it has the flexibility you need for a risk solution that’s all your own.

Designed for teams. Delivered to take you further.

Risk management isn’t the responsibility of one person. Protecht’s clean, easy-to-use solutions help you engage and empower more of your team – so that risk ownership reaches more of your organisation. That means less time chasing teammates on the day-to-day tasks. And more time focusing on strategic work that makes the biggest difference.

Get the expertise. Experience success.

No two organisations are the same – and that includes how they manage risk. For over twenty years we’ve been partnering with clients across all kinds of industries to implement ERM solutions that adapt to their needs and set them up for success. Our team can quickly implement a way forward that works for you – and then keep you at the forefront of any key changes to the risk landscape.

.png)

Trusted by well known organisations

Risk management. End-to-end.

All the tools and insights you need to not only measure and monitor risks, but to take the right actions too.

-

Link and structure your data to gain a holistic view of your business’s risk profile.

-

Lift your risk culture as every user builds their risk awareness and sense of ownership.

-

Prioritise the right initiatives with action-oriented insights from dashboards and reports.

-

Replace out-of-date siloed documents with a system built for enterprise risk management.

-

Continually measure and improve your risk management with insights into performance over time.

-

Find the right entry level with pre-configured solutions and expand into new use cases as you grow your risk maturity.

Our expertise. Your success.

A platform envisioned and built by ERM specialists. Advisors and tech support teams with years of experience. It’s not just a product – it’s a relationship.

-

Protecht has been at the forefront of enterprise risk management.

-

Grow your risk expertise using the wide range of courses and learning materials available on Protecht Academy.

-

Find the right solutions and grow at the right pace for your business with our experienced advisers.

-

Fast-track your implementation with pre-designed solutions to cover core risk management and grow into new use cases.

Recognised by analysts and customers

Protecht recognised across analyst reports.

We believe Protecht continues to be recognised for innovation, customer satisfaction, and ease of use. We’ve been named in G2's Top 50 GRC vendors, a SPARK Matrix Leader for GRC platforms, and a 2025 RiskTech100 company by Chartis.

The insights that Protecht can provide are really out of this world. It’s literally been life-changing.

- Rishad Paul Smartt, Senior Risk and Compliance Manager, NZAA

Protecht provided the New Zealand Automobile Association with a comprehensive ERM system that shifted risk ownership to the first line with seamless customisation and implementation.

Find out more:

“We needed an efficient, scalable system that would enable every user to take personal ownership of ERM. Protecht has really helped us. The fact that our users can go into the system, update their own key risk indicators, update their own risks, has been really powerful.”

Tsam Jeffries

Director of Enterprise and Operational Risk, WorldRemit

“Our business is much more risk-aware now. Protecht has given senior management the ability to see what is happening within different business functions, and this in turn allows the C-suite to plan for the future using a risk lens.”

John Bastow

Chief Compliance and Risk Officer, Impax

“We needed a system we could live and grow with, not just something to fix our immediate needs. Protecht is just intuitive in terms of its design usage. You don't get many basic questions from users. They just log in and use it.”

Raj Hit

Head of Risk & Assurance, Lotto NZ

“Many ‘customisable’ systems require expensive tech support services. But with Protecht, our complex global ERM systems can be customised by the very people who use them... We routinely produce new registers in as little as one day.”

Cameron Drinan

Risk & Compliance Manager, Pinnacle Investments

APRA's CPS 230 and Protecht ERM

Need to meet CPS 230? Meet our solution.

Cover all the requirements of the CPS 230 standard with Protecht’s single, off-the-shelf ERM solution. Ensure that risk stakeholders, the executive and board have insight into critical operations, material service providers, risks and controls.

Knowledge hub

Find out the latest hot topics in risk management by checking out our Webinars, eBooks, white papers, guides, blogs and more. Subscribe to our newsletters to ensure you never miss out on the latest events.

Work with us

Become a risk-taker. Help the world embrace risk.

Request a demo

A platform with endless possibilities to add to your business’s safety and success.

Subscribe to the Knowledge hub.

Get practical resources, eBooks and webinar invites in your inbox regularly.

.png)

-1.png)